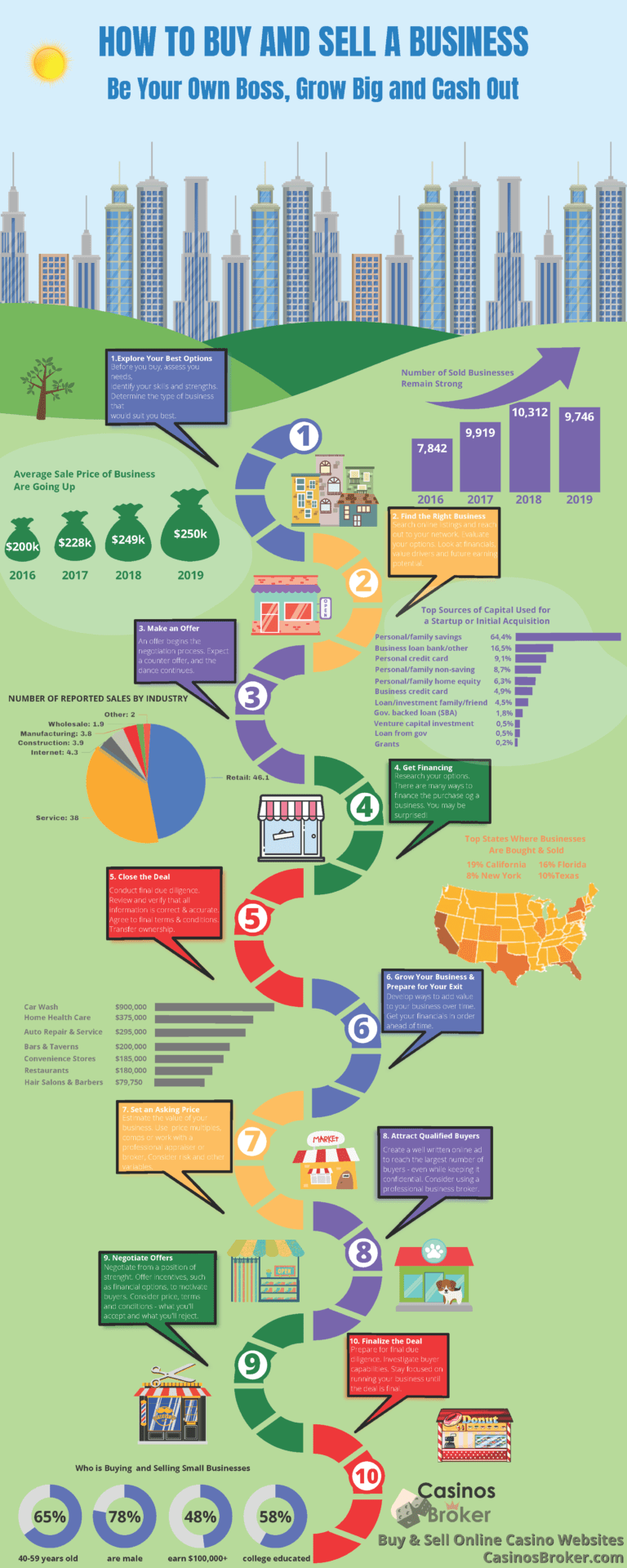

Sé tu propio jefe, crece y cobra

Cómo comprar y vender una empresa: una guía completa

¿Está pensando en comprar o vender un negocio? Si es así, está en el lugar indicado. Esta guía completa le guiará a través del proceso de compra o venta de un negocio, de principio a fin.

Entendiendo el mercado empresarial

Antes de comenzar el proceso de compra o venta de un negocio, es importante comprender el estado actual del mercado empresarial. El mercado de compraventa de negocios varía según el sector, la ubicación y las condiciones económicas actuales. Para comprender mejor el mercado, investigue las tendencias de ventas actuales y recopile información sobre negocios similares al que le interesa comprar o vender.

Preparación para la venta de una empresa

Si va a vender un negocio, el primer paso es prepararlo para la venta. Esto implica evaluar el rendimiento financiero y la condición física del negocio, así como abordar cualquier asunto legal u operativo que pueda afectar la venta. También deberá considerar el mejor momento para vender, considerando factores como las condiciones del mercado, la competencia y las tendencias económicas.

Encontrar un comprador

Una vez que haya preparado el negocio para la venta, el siguiente paso es encontrar un comprador. Hay varias maneras de hacerlo, como recurrir a un agente comercial, anunciarse en línea o usar las redes sociales para difundir la información. Es importante considerar la experiencia del comprador, su capacidad financiera y sus planes para el negocio al evaluar a los posibles compradores.

Negociando la venta

Una vez encontrado un comprador, el siguiente paso es negociar los términos de la venta. Este proceso implica establecer un precio, acordar la estructura de pago y negociar cualquier otro término y condición. Es importante comprender claramente las intenciones y expectativas del comprador para garantizar que los términos de la venta sean justos para ambas partes.

Cerrando la venta

Una vez acordados los términos de la venta, llega el momento de cerrar el trato. Este proceso implica la transferencia de la propiedad del negocio, la transferencia de activos y la liquidación de cualquier obligación legal o financiera pendiente. El proceso de cierre puede tardar desde varias semanas hasta varios meses, dependiendo de la complejidad de la venta.

Preparación para la compra de un negocio

Si va a comprar un negocio , el primer paso es prepararse para el proceso. Esto implica evaluar su capacidad financiera, investigar negocios potenciales y recopilar información sobre el mercado empresarial actual. También deberá considerar sus objetivos para el negocio, incluyendo sus planes de crecimiento y expansión.

Encontrar un negocio para comprar

Una vez preparado para el proceso, el siguiente paso es encontrar un negocio para comprar. Hay varias maneras de hacerlo, como recurrir a un agente de negocios, buscar en línea o asistir a eventos del sector. Es importante evaluar el rendimiento financiero, la condición física y la situación legal del negocio antes de realizar la compra.

Negociando la compra

Una vez que haya encontrado un negocio para comprar, el siguiente paso es negociar los términos de la compra. Este proceso implica establecer un precio, acordar la estructura de pago y negociar cualquier otro término y condición. Es importante comprender claramente las intenciones y expectativas del vendedor para garantizar que los términos de la compra sean justos para ambas partes.

Cierre de la compra

Una vez acordados los términos de la compra, llega el momento de cerrar el trato. Este proceso implica la transferencia de la propiedad del negocio, la transferencia de activos y la liquidación de cualquier obligación legal o financiera pendiente. El proceso de cierre puede tardar desde varias semanas hasta varios meses, dependiendo de la complejidad de la compra.