Introduction: The Dominican Republic’s Emerging iGaming Landscape

The Dominican Republic stands at a fascinating crossroads in the global iGaming industry. This Caribbean nation of over 11 million people has long been recognized for its vibrant tourism sector, which contributes approximately 15.8% to the country’s GDP—roughly $21 billion annually. For decades, land-based casinos have thrived in resort destinations like Punta Cana and Puerto Plata, with more than 60 casino venues catering primarily to international visitors. These brick-and-mortar establishments have operated for over half a century, while domestic gambling activity has centered largely around lottery games.

However, the Dominican iGaming market experienced a transformative shift in March 2024 with the implementation of Resolution 136-2024. After nearly a decade of minimal oversight, this comprehensive regulatory framework brought online casinos, sports betting, poker, and bingo under the supervision of the Ministry of Finance. The resolution introduced critical compliance requirements, including mandatory local server usage and responsible gambling policies, effectively legitimizing the online gambling sector.

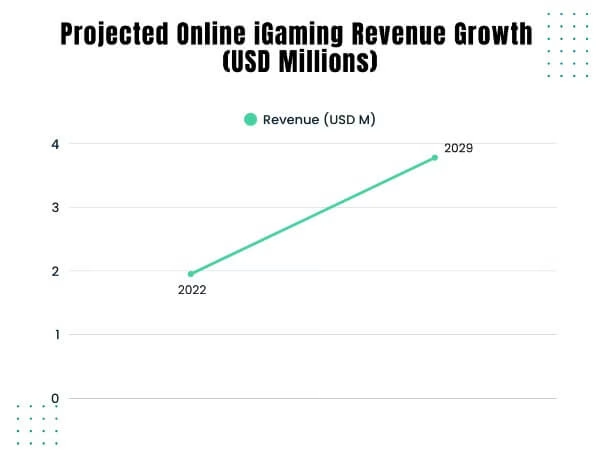

With 90% smartphone penetration and a tech-savvy population increasingly comfortable with digital transactions, the Dominican Republic presents compelling opportunities for online casino operators and sportsbook platforms. Industry analysts project online betting revenues will reach $3.78 million by 2029, representing a compound annual growth rate (CAGR) of 10.64%. Additionally, tourism continues its upward trajectory, with cruise passenger arrivals surging 166% above 2019 levels, creating a robust foundation for both land-based and online gambling expansion.

Market Overview and Revenue Projections

The Dominican Republic’s gambling industry encompasses both traditional casino gaming and a rapidly developing online gambling sector. Total gaming revenues demonstrated strong recovery in 2023, with first-half gambling revenues reaching DOP 2.16 billion (approximately US$37 million), positioning the full-year total near US$74 million. The introduction of regulated online gaming channels has created new revenue streams, particularly through mobile casino applications.

Revenue from online casino apps stood at just US$1.95 million in 2022, but this figure is expected to nearly double to US$3.78 million by 2029. This growth trajectory reflects the 10.64% CAGR driven primarily by increasing smartphone adoption and improved internet infrastructure. The broader digital games market, encompassing various gaming formats beyond traditional gambling, is projected to reach US$565 million by 2030, growing at an impressive 8.26% CAGR.

The Dominican Republic currently hosts over 60 casino venues, though some licensing directories report only 35 officially licensed casinos, suggesting potential discrepancies in regulatory oversight. These establishments concentrate in high-traffic tourist areas where they benefit from the country’s growing visitor numbers. Early 2025 data indicates the nation welcomed approximately 8 million tourists, representing a 49% increase compared to pre-COVID levels. This tourism boom directly fuels demand for slot games, table games, and other casino offerings.

Key Market Metrics at a Glance:

| Metric | Value | Timeframe |

|---|---|---|

| Total Gambling Revenue (H1) | DOP 2.16B (US$37M) | 2023 |

| Online Casino Apps Revenue | US$1.95M | 2022 |

| Projected Online Revenue | US$3.78M | 2029 |

| Online CAGR | 10.64% | 2022–2029 |

| Broader Games Market | US$565M | 2030 |

| Casino Venues | 60+ | 2025 |

| Tourist Visitors | 8M | Early 2025 |

Market Size, Growth Drivers, and Tourism Impact

The Dominican iGaming market derives its strength from an unusual dual-revenue model: tourism-driven casino gaming and locally popular lottery products. Land-based casino operations cluster predominantly in resort destinations such as Punta Cana, Santo Domingo, and Puerto Plata, where they serve as entertainment amenities for international visitors. The tourism industry’s contribution of roughly $21 billion annually creates a steady stream of customers for these casino floors.

Tourism metrics reveal impressive growth that directly correlates with casino revenue expansion. The 8 million visitors recorded in early 2025 represent significant recovery from pandemic lows and surpass pre-2020 benchmarks by 49%. Perhaps more remarkably, cruise traffic has exploded, with passenger arrivals increasing between 100% and 166% since 2019, depending on the port. These cruise passengers, though spending less time on shore than traditional hotel guests, still contribute meaningfully to casino and slot machine revenues.

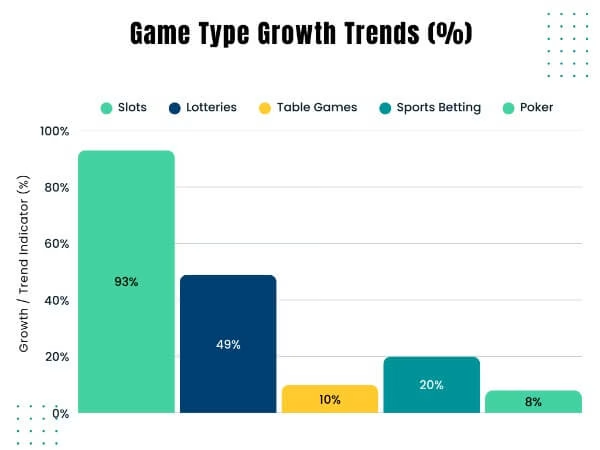

Within the online gambling segment, lottery games and slot games have emerged as the fastest-growing categories over the past seven years, with growth rates of 93% and 49% respectively. These formats appeal to different player psychographies—lotteries attract budget-conscious locals seeking affordable entertainment, while online slots cater to both tourists looking for convenient mobile gaming and younger demographics comfortable with digital platforms.

Within the online gambling segment, lottery games and slot games have emerged as the fastest-growing categories over the past seven years, with growth rates of 93% and 49% respectively. These formats appeal to different player psychographies—lotteries attract budget-conscious locals seeking affordable entertainment, while online slots cater to both tourists looking for convenient mobile gaming and younger demographics comfortable with digital platforms.

Industry projections suggest the total online gaming market, including social and casual gaming beyond regulated gambling, could reach US$565 million by 2030, expanding at an 8.26% CAGR. While precise player counts remain unreported by regulatory authorities, estimates align active players with tourism volume—millions of annual participants—though most Dominican residents primarily engage with lottery products rather than casino games or sports betting platforms.

The regulatory clarity provided by Resolution 136-2024 has catalyzed investor interest, particularly in mobile-first casino platforms and sportsbook applications. As internet connectivity improves and payment infrastructure modernizes, the gap between land-based and online gambling revenue is expected to narrow, though resort casinos will likely maintain dominance through at least the end of the decade.

Popular Game Types in the Dominican Market

Understanding game preferences in the Dominican Republic requires recognizing the distinct tastes of tourists versus local residents. Slot machines reign supreme across both land-based resort floors and mobile casino apps, benefiting from their accessibility and the minimal skill required. Industry data shows slots experiencing 93% growth over a seven-year period, making them the single most popular casino game format. Their visual appeal, varied themes, and potential for quick wins resonate strongly with casual players and serious gamblers alike.

Lottery games occupy a unique position in Dominican gambling culture. The state-run Lotería Nacional maintains a monopoly on traditional lottery draws, which have become deeply embedded in everyday life for many residents. Interactive lottery formats have proven particularly popular locally, offering participation through both physical ticket purchases and digital channels. Lottery growth of 49% over seven years demonstrates sustained demand for this accessible, low-stakes gambling option.

Sports betting and poker represent emerging segments within the Dominican online gambling market. Prior to Resolution 136-2024, these verticals operated in a regulatory gray area, but the new framework has enabled licensed platforms to offer legal sports wagering and poker rooms. Physical casinos in tourist destinations have long featured poker rooms catering to visiting players, and this infrastructure is now being complemented by online poker platforms. The sports betting vertical shows particular promise given the Dominican population’s passion for baseball and international sports leagues.

Sports betting and poker represent emerging segments within the Dominican online gambling market. Prior to Resolution 136-2024, these verticals operated in a regulatory gray area, but the new framework has enabled licensed platforms to offer legal sports wagering and poker rooms. Physical casinos in tourist destinations have long featured poker rooms catering to visiting players, and this infrastructure is now being complemented by online poker platforms. The sports betting vertical shows particular promise given the Dominican population’s passion for baseball and international sports leagues.

Table games such as blackjack and roulette remain staples of resort casino floors, providing the classic gambling experience that many tourists expect. These games cluster in high-end venues within four-star and five-star hotels, where they benefit from professional dealer staffing and atmospheric casino environments. While table game growth appears steadier rather than explosive, they maintain consistent revenue contribution through high-value bets placed by experienced gamblers.

Bingo and mobile-first phone games round out the Dominican gambling ecosystem. These formats align with the market’s mobile-first trend, with 90% smartphone penetration enabling convenient access to gaming apps. Younger demographics particularly favor these accessible formats, which require minimal time commitment and offer social elements through multiplayer features.

Game Type Comparison:

| Game Type | Popularity Rank | Growth Projection | Key Notes |

|---|---|---|---|

| Slots | 1 | 93% (7 yrs) | Resort floors, mobile apps |

| Lotteries | 2 | 49% (7 yrs) | Lotería Nacional monopoly |

| Table Games | 3 | Steady | Blackjack/roulette in tourist hubs |

| Sports Betting | 4 | Emerging | Post-2024 online licenses |

| Poker | 5 | Niche | Casino rooms, online potential |

Player Demographics and Behavioral Insights

The Dominican Republic’s gambling market displays distinct demographic patterns that operators should understand when designing casino bonuses, loyalty programs, and game selections. Younger adults dominate the player base, with individuals aged 18 to 39 representing approximately 70% of all active gamblers. This skew toward younger players aligns with global iGaming trends and reflects the demographic’s comfort with digital payment methods and mobile-first casino platforms.

Breaking down the youth segment further, players aged 25 to 34 constitute the largest cohort at 40-47% of total participants. This millennial group demonstrates preference for multiplayer gaming experiences and typically engages in weekly gaming sessions lasting three to five hours. Their sustained engagement makes them valuable long-term customers for both online casinos and land-based venues. The 18 to 24 age bracket (Generation Z) accounts for approximately 25% of players and gravitates toward action-oriented content, including sports betting and fast-paced slot games that deliver “quick wins” rather than strategic gameplay.

Gender distribution within Dominican gambling markets heavily favors male participants, who comprise between 75% and 82% of the user base depending on the game type. Female participation currently ranges from 18% to 25%, though industry analysts anticipate this percentage will grow as online casinos develop more inclusive marketing approaches and game selections. Women show relatively stronger preference for slot games and lottery products compared to poker or sports betting.

Gaming preferences correlate strongly with whether players are tourists or residents. International visitors tend to engage with casino floor offerings—slots, table games, and poker rooms—viewing gambling as part of their vacation entertainment budget. Local residents demonstrate markedly different behavior, showing strong preference for lottery products operated by Lotería Nacional, which offer affordable stakes and culturally familiar formats. This segmentation creates distinct marketing opportunities for operators targeting different player pools.

Age also influences strategic approach to gambling. Players aged 35 and older display greater interest in games requiring skill and strategy, such as poker and blackjack, while younger demographics favor the immediate gratification of slots and quick-outcome sports bets. Regional data indicates most active players engage in weekly sessions averaging three to five hours, suggesting habitual rather than sporadic gambling behavior.

Player Demographics Summary:

| Demographic | Percentage | Preferences | Notes |

|---|---|---|---|

| Age 18–24 (Gen Z) | 25% | Sports/action | Mobile-first approach |

| Age 25–34 | 40–47% | Multiplayer games | Weekly 3–5 hour sessions |

| Age 18–39 Overall | 70% | Quick wins | Online gambling dominant |

| Male | 75–82% | Strategy games | Regional preference tilt |

| Female | 18–25% | Rising participation | Slots/lotteries preferred |

Regulatory Framework and Licensing Requirements

The Dominican Republic operates under a dual regulatory system that separately governs land-based casinos and online gambling platforms. Understanding this framework is essential for any operator considering market entry, as compliance requirements are extensive and penalties for violations can be severe.

Historical Regulations and Current Oversight

Land-based casino operations fall under Ley 139-11, enacted in 2011, which established comprehensive rules for physical gambling establishments. This law mandates that casinos can only operate within four-star hotels or higher-rated properties, a restriction designed to tie gambling to tourism infrastructure. The Dirección de Casinos y Juegos de Azar (DCJA), operating under the Ministry of Finance, serves as the primary regulatory authority for both land-based and online gambling operations.

Online gambling languished in regulatory limbo for nearly a decade until Resolution 136-2024 brought digital platforms under formal oversight in March 2024. This 36-page resolution, structured across seven chapters, created a comprehensive legal framework for online casinos, sports betting platforms, poker rooms, and bingo offerings. The regulation establishes 18 as the minimum age for all forms of gambling and requires operators to implement responsible gambling measures, including self-exclusion options and betting limits.

Beyond DCJA oversight, the lottery sector operates under Lotería Nacional’s monopoly, while the Secretariat of Sports maintains jurisdiction over licensed sports betting shops. This fragmented regulatory landscape can create compliance challenges for operators seeking to offer multiple product verticals.

Licensing Process and Requirements

Obtaining a gambling license in the Dominican Republic requires substantial capital investment and extensive documentation. The DCJA issues separate licenses for land-based and online operations, each with distinct requirements. Land-based licenses link to specific casino or slot machine venues within approved hotels and carry five-year terms. Online gambling licenses command a fixed fee of approximately US$346,000 for combined casino and sports betting operations, also valid for five years with restrictions on transferability during the first three years.

Applicants must demonstrate commercial registration, financial solvency, and legal source of funds. Performance bonds are required, along with criminal background checks for key personnel and operators. Online platforms face additional technical requirements, most notably the mandate to operate servers and domains within Dominican territory. This local server requirement aims to ensure regulatory oversight and prevent unlicensed international operators from serving Dominican customers.

Technical standards cover game fairness, player data protection, and responsible gambling tools. Operators must submit to regular audits verifying compliance with anti-money laundering (AML) regulations, a priority for Dominican authorities seeking to prevent financial crimes.

Taxation Structure

Taxation Structure

The Dominican tax regime for gambling operators ranks among the region’s more substantial. All licensed operators, whether land-based or online, must pay 29% tax on gross gaming revenue (GGR)—the amount wagered minus winnings paid to players. This rate applies universally across casino games, sports betting, and other licensed gambling activities.

Gaming machine operators face an additional 5% monthly tax calculated on gross sales, payable to the Dirección General de Impuestos Internos (DGII). Land-based casinos encounter further taxation tiers based on their number of gaming tables. Venues operating 1 to 15 tables pay approximately RD$55,853 (roughly US$946) per table, while larger establishments with more than 35 tables face RD$85,927 per table. These tiered fees encourage larger, more established operations while potentially deterring smaller entrants.

Compliance obligations extend beyond tax payments. Operators must maintain detailed records for AML reporting, ensure game integrity through certified random number generators, restrict gambling to approved zones, and face penalties for violations that can include fines and imprisonment of up to 10 years for serious infractions.

Upcoming Legislative Changes

President Abinader’s administration has proposed significant regulatory reforms scheduled for congressional consideration in June 2025. The draft legislation would create the Dirección General de Juegos de Azar (DGJA) as a dedicated gambling regulator with enhanced investigative powers and independence from the Ministry of Finance. The bill proposes stricter zoning requirements for casino locations, reinforces the restriction of casino operations to four-star and higher hotels, and refines tax structures and slot machine regulations.

If approved—potentially by 2026—these changes could substantially alter the compliance landscape. The creation of DGJA would centralize regulatory authority and likely increase enforcement against unlicensed operators, a persistent challenge in the current environment. Enhanced online enforcement mechanisms are expected to target gray-market platforms operating without proper Dominican licenses.

Regulatory Framework Overview:

| Aspect | Details | Authority | Key Requirement |

|---|---|---|---|

| Main Regulator | DCJA (Ministry of Finance) | Land-based/online | Audits, AML compliance |

| Online License Fee | US$346K (casino + sports) | Resolution 136-2024 | 5-year term |

| GGR Tax | 29% | All operators | Monthly to DGII |

| Slots Tax | 5% gross sales | Land-based venues | RD$55K–85K per table tiers |

| Upcoming Bill | DGJA creation | June 2025 | Zoning, hotel limits |

Competitive Landscape: Key Operators and Market Share

The Dominican iGaming industry features a competitive landscape dominated by established resort-based casino operators, with online gambling platforms only beginning to gain traction following Resolution 136-2024. Understanding the key players and their strategic positioning provides insight into market dynamics and potential partnership opportunities.

Major Casino Operators

International resort operators command the largest market presence, leveraging their integration with high-traffic tourist properties. Hard Rock International operates flagship venues including the Hard Rock Hotel & Casino Punta Cana, which attracts substantial visitor volume through brand recognition and prime resort locations. CIRSA, a prominent European gaming company, manages slot machine operations and table games across multiple Dominican resort properties, demonstrating the value of multi-venue strategies.

Local and regional operators maintain meaningful market share through operational flexibility and established relationships within Dominican business networks. Foliatti Casino operates multiple outlets across tourist zones, while PlayCity, Royal Yak, and Fortuna Casino focus on nimble, tourist-facing operations that can adapt quickly to changing market conditions. Riu Palace Macao represents another integrated model, embedding casino gaming within its broader resort offerings.

The lottery sector operates under entirely different dynamics. Lotería Nacional maintains a state-granted monopoly on traditional lottery draws and interactive lottery products, capturing the majority of local gambling spend. This monopoly status insulates lottery operations from competitive pressures but also limits innovation compared to more competitive markets.

Online gambling remains in its infancy within the Dominican Republic, with few licensed operators currently active. However, international firms have expressed strong interest in market entry following regulatory clarity. GoldenRace showcased virtual sports betting platforms at the GAT Expo 2025 in Santo Domingo, signaling growing industry attention to Dominican online opportunities. Most estimates suggest the licensed online gambling sector currently represents less than 5% of total market share, though this percentage is expected to grow substantially through 2029.

Market Share Distribution

Precise market share data for Dominican gambling operators remains limited due to private ownership structures and minimal public disclosure requirements. However, industry analysis based on venue count, visitor traffic, and revenue indicators suggests the following approximate distribution:

Resort-based casino operators, particularly international brands like Hard Rock and CIRSA along with integrated properties like Riu, likely command 60-70% of total casino gaming revenue. Their dominance stems from strategic positioning in high-traffic tourist zones where they benefit from approximately 8 million annual visitors and 1.6 million cruise passengers. These operators also benefit from economies of scale in marketing, technology infrastructure, and dealer training.

Independent local casino operators, including Foliatti and PlayCity, probably account for 20-30% of casino revenue. While smaller individually, these operators collectively maintain significant presence through flexibility in secondary markets and longstanding relationships with local business partners. Their regional expertise and lower overhead structures can provide competitive advantages in specific venues.

Lottery operations dominate local gambling participation, though precise revenue share is complicated by different price points compared to casino games. Lotería Nacional’s monopoly ensures it captures nearly all lottery-related spending, representing the highest-frequency gambling activity among Dominican residents.

Online gambling platforms currently occupy less than 5% of market share but represent the highest-growth segment. The projected increase from US$1.95 million in 2022 to US$3.78 million by 2029 suggests this category could double its market presence within the forecast period.

Market Share Estimates:

| Operator Category | Estimated Share | Key Strengths |

|---|---|---|

| International Resorts | 60–70% | Tourism volume, premium slots/tables |

| Local Casinos | 20–30% | Operational flexibility, regional ties |

| Lottery | Dominant (local) | Everyday play, monopoly status |

| Online Newcomers | <5% | Mobile growth potential, tech adoption |

Strategic Partnerships and Alliances

Collaboration models define competitive strategy in the Dominican gambling sector. Resort lease arrangements enable casino operators to secure long-term gaming concessions within established hotel properties. Hard Rock and CIRSA have developed successful partnership models with hotel chains including Riu and Meliá, providing gaming operations within their resort portfolios. These arrangements align incentives—hotels gain additional amenity offerings while casino operators access pre-existing customer flow.

Technology integration partnerships are emerging as online gambling expands. GoldenRace’s alliance with industry expos for virtual betting demonstrations exemplifies how software providers are building brand awareness and establishing local relationships ahead of broader market launches. CIRSA supplies slot machines to multiple venues, demonstrating the value of equipment-level partnerships that transcend single-venue operations.

For online market entrants, partnerships with locally established entities may prove essential for navigating regulatory requirements, particularly the local server mandate. Post-2024, international gambling platforms have begun seeking DCJA-approved technology partners who can ensure compliance while maintaining operational efficiency.

Tourism synergies create additional partnership opportunities. Cruise ports such as Amber Cove maintain informal marketing relationships with nearby casino venues in Puerto Plata, directing passenger traffic toward licensed gambling establishments. As the cruise industry continues its dramatic growth trajectory, these tourism-gambling linkages are likely to deepen.

Consumer Trends: Payment Methods and Technology Adoption

Dominican gambling consumers display behavioral patterns shaped by tourism infrastructure, cultural traditions, and rapidly evolving digital payment adoption. Understanding these trends enables operators to optimize their platforms for local and international player preferences.

Player Behavior Patterns

Tourist gamblers and local residents demonstrate markedly different engagement patterns with casino gaming and online gambling platforms. International visitors typically favor slot machines and table games during resort stays, viewing gambling as vacation entertainment rather than serious wagering. Their sessions tend to be short but high-frequency, concentrated during multi-day hotel stays. Spending per session varies widely based on tourist demographics, with luxury resort guests potentially wagering significantly more than budget travelers.

Local residents prioritize lottery products for their affordability and cultural familiarity, with sports betting gaining traction among younger demographics following Resolution 136-2024. The regulatory clarity provided by the new framework has legitimized online sports wagering, removing stigma and encouraging broader participation. Lotteries remain culturally embedded as social rituals, often purchased as part of daily routines rather than dedicated gambling sessions.

Gaming session data indicates Dominican players who engage with casino games or online gambling platforms typically spend three to five hours weekly on these activities. This pattern suggests habitual engagement rather than occasional play, creating opportunities for loyalty programs and bonus structures that reward consistent participation. Generation Z players (aged 18-24) gravitate toward action-oriented content and sports betting, while millennials prefer multiplayer formats that incorporate social elements.

Responsible gambling tools such as deposit limits and self-exclusion options are gaining acceptance as regulators mandate their inclusion and players become more aware of problem gambling risks. Operators that proactively promote responsible gaming measures may benefit from enhanced regulatory relationships and positive brand perception.

Payment Method Preferences

Digital payment adoption in the Dominican Republic has accelerated dramatically, transforming how players fund their gambling activities. Credit cards dominate online transactions at approximately 66% of e-commerce payments, providing convenience and widespread acceptance across both international and domestic platforms. Debit cards account for roughly 21% of digital transactions, appealing to players who prefer to limit spending to available funds rather than credit lines.

E-wallets and alternative payment methods (APMs) represent approximately 7% of current payment volume but show strong growth trajectories. Mobile wallet adoption is increasing as smartphone penetration reaches 90% and younger demographics seek payment options that integrate seamlessly with mobile casino apps. This shift away from cash—which historically dominated 75% of transactions—reflects broader economic digitalization and improved financial infrastructure.

Contactless payment systems are appearing in resort casinos, aligning with tourism technology expectations and reducing transaction friction for international visitors accustomed to tap-to-pay systems. Some regional platforms have piloted cryptocurrency options, though regulated Dominican gambling sites currently focus on fiat currency transactions to maintain compliance with financial oversight requirements.

Payment processing speed and reliability significantly impact user experience. Online casino platforms that offer instant deposits and rapid withdrawal processing gain competitive advantages, particularly among experienced players who value liquidity. The 29% GGR tax structure incentivizes operators to optimize payment flows and reduce abandoned transactions.

Technology Trends Shaping the Market

Mobile-first design has become non-negotiable for online gambling success in the Dominican Republic. With 90% smartphone penetration, players expect seamless mobile casino experiences that rival desktop platforms. This mobile preference extends across demographics but proves especially pronounced among younger players who may lack regular computer access. Progressive web apps (PWAs) and native mobile applications both serve this market, though app store restrictions in some jurisdictions favor web-based approaches.

Social media and industry expos are driving awareness of emerging formats like virtual sports betting. Platforms that integrate social sharing features and competitive leaderboards tap into cultural preferences for communal gaming experiences. Live dealer casino games, which combine digital convenience with human interaction, are gaining popularity among players seeking authentic casino atmosphere without resort travel.

The cultural context surrounding gambling in the Dominican Republic reflects both tourism normalization and traditional Catholic influences that emphasize moderation. The 8 million annual tourists have normalized casino gaming as a resort amenity, reducing stigma particularly in tourist zones. However, religious and family values continue to promote controlled play over excessive gambling, creating demand for platforms that facilitate responsible gaming through transparent limits and self-monitoring tools.

Virtual sports and metaverse integration represent frontier opportunities as global gaming trends penetrate the Dominican market. Early adopters may establish brand leadership, though regulatory clarity on these emerging formats remains limited.

Consumer Trends Summary:

| Trend | Details | Driver |

|---|---|---|

| Payments | Credit 66%, Debit 21%, E-wallets 7% | Mobile boom, digitalization |

| Technology | 90% smartphone penetration | Online gambling shift |

| Behavior | 3–5 hour weekly sessions | Youth preferences, accessibility |

| Cultural | Tourism normalizes casino gaming | 8M annual visitors |

Strategic Opportunities and Industry Challenges

The Dominican iGaming market presents a compelling value proposition for operators willing to navigate regulatory complexity and invest in compliance infrastructure. However, success requires understanding both the significant opportunities and substantial challenges that define this emerging market.

Market Opportunities

Regulatory clarity following Resolution 136-2024 represents the single most important opportunity for licensed operators. After years of gray-market uncertainty, legitimate platforms can now operate with legal certainty, access banking services, advertise openly, and build sustainable businesses without regulatory risk. This clarity particularly benefits international operators seeking new markets, as the Dominican Republic offers a structured entry path into the Caribbean iGaming ecosystem.

The tourism sector’s robust performance creates a massive potential customer base. With $21 billion in annual tourism revenue representing 15.8% of GDP, gambling operators can tap into consistent visitor flow that shows little sign of slowing. The 166% increase in cruise passenger arrivals since 2019 demonstrates particular strength in short-duration tourism that still generates casino revenue. Operators who successfully position their offerings as vacation entertainment can benefit from tourism growth projections suggesting continued 4-5% GDP expansion through at least 2026.

Mobile sports betting and online casino platforms address an underserved market segment. Despite 90% smartphone penetration, online gambling revenue remains minimal at under 5% of total market share. This gap represents greenfield opportunity for operators who can deliver user-friendly mobile experiences optimized for Dominican payment preferences and internet infrastructure. The projected 10.64% CAGR for online casino apps through 2029 suggests substantial revenue potential for early movers.

Resort partnership models offer accelerated market entry with reduced capital requirements. Rather than developing standalone properties, casino operators can negotiate gaming concessions within existing four-star and five-star hotels, immediately accessing their customer base and infrastructure. These partnerships align incentives and distribute risk while enabling rapid scaling across multiple venues.

Emerging verticals including esports betting and metaverse gambling experiences may provide differentiation opportunities as these formats gain global traction. While regulatory frameworks for these innovations remain undefined, operators who engage with Dominican authorities on appropriate oversight could shape future regulations favorable to their business models.

Geographic concentration in Punta Cana, the highest-traffic tourist destination, offers economies of scale and marketing efficiency. Multiple casino venues in proximity create gambling districts that attract players who might otherwise skip casino gaming, amplifying overall market size.

Industry Challenges

Compliance requirements under Resolution 136-2024 impose substantial operational burdens. The local server mandate requires significant technology infrastructure investment specifically for the Dominican market, reducing economies of scale that multi-jurisdiction operators typically achieve. Performance bonds, criminal background checks, and ongoing AML reporting create administrative overhead that disadvantages smaller operators lacking dedicated compliance teams.

The 29% GGR tax rate ranks among the region’s highest, directly impacting operator profitability and limiting resources available for customer acquisition, game development, and competitive casino bonuses. When combined with the 5% gross sales tax on gaming machines and per-table fees for land-based casinos, the total tax burden substantially exceeds rates in more established gambling jurisdictions. Operators must achieve higher customer lifetime values or greater operational efficiency to maintain profitability.

Established resort operators enjoy significant competitive advantages through existing infrastructure, brand recognition, and regulatory relationships. New entrants face the challenge of differentiating their offerings and attracting players away from well-known brands like Hard Rock. Land-based casinos benefit from sunk cost advantages—their facilities already exist and generate revenue, while new operators must commit capital before revenue generation begins.

Illegal gambling operations persist despite regulatory frameworks, undercutting licensed operators who bear compliance costs. Unlicensed platforms can offer better odds, larger bonuses, and lower transaction fees because they avoid taxation and regulatory requirements. Until enforcement substantially increases—potentially through the proposed DGJA regulatory agency—this gray market will continue diverting revenue from legitimate channels.

Tourism volatility introduces revenue risk that operators cannot control. Economic downturns, natural disasters, disease outbreaks, or geopolitical events can dramatically reduce tourist arrivals, directly impacting casino revenues. The COVID-19 pandemic demonstrated this vulnerability, though recovery has been strong. Operators dependent on tourism must maintain financial reserves to weather inevitable downturns.

Responsible gambling obligations require investment in player protection tools, staff training, and monitoring systems. While these measures benefit long-term industry sustainability, they impose short-term costs and may reduce revenue from problem gamblers who generate disproportionate gambling volume. Balancing regulatory compliance, ethical obligations, and profitability remains an ongoing challenge.

Conclusion: Future Outlook for iGaming in the Dominican Republic

The Dominican Republic stands at an inflection point in its iGaming journey. The implementation of Resolution 136-2024 has transformed a largely unregulated online gambling market into a structured, licensed industry with clear rules and growth potential. Tourism continues driving demand for casino gaming, while smartphone penetration and digital payment adoption create ideal conditions for online gambling expansion.

For operators considering market entry, the strategic priorities are clear: secure DCJA licensing immediately to establish first-mover advantage, pursue partnership models with established resort properties to accelerate market access, and prioritize mobile-optimized platforms that align with Dominican consumer preferences. Responsible gambling features should be embedded from launch rather than added retroactively, both for regulatory compliance and brand differentiation.

Investor interest in Dominican sports betting innovation appears justified, with the segment positioned for double-digit compound annual growth through 2029. The combination of passionate sports fans, improved regulatory clarity, and mobile-first technology creates favorable conditions for sportsbook platforms that can deliver localized content and competitive odds.

Looking ahead, the proposed DGJA regulatory agency could substantially improve enforcement against unlicensed operators, potentially accelerating the shift from gray market to legitimate platforms. Operators who have invested in compliance infrastructure will benefit disproportionately from enhanced enforcement.

The Dominican iGaming market offers compelling opportunities for operators willing to commit to regulatory compliance, cultural adaptation, and long-term market development. Success will require patience, partnership savvy, and platforms optimized for both tourist entertainment and local engagement. Those who meet these requirements may find the Dominican Republic to be one of the Caribbean’s most promising iGaming markets for the next decade.

Ready to explore opportunities in the Dominican Republic’s growing iGaming sector? Stay informed about regulatory developments and market trends that could impact your expansion strategy.