Launching an online casino is not just a build-vs-buy decision; it’s a capital allocation and risk-transfer question that shapes exit optionality and valuation. Beyond company formation and licensing, operators must secure robust payment coverage, negotiate with multiple PSPs and alternative payment methods (APMs), integrate a defensible tech stack, and implement 24/7 support. The fastest path to market is usually through a white-label arrangement; the highest control and value creation tend to come from a turnkey/standalone build on a reputable license. The right choice depends on your time horizon, risk tolerance, and investor narrative.

Executive summary for founders & investors

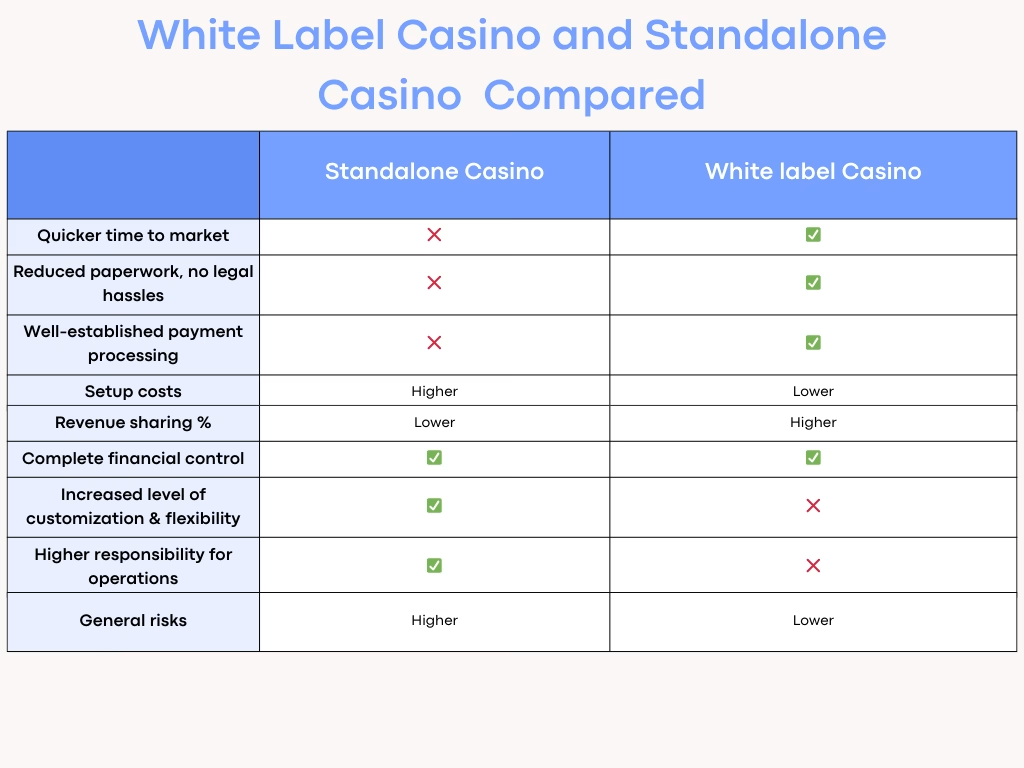

White label casinos offer speed and lower upfront spend by operating under a provider’s umbrella license with shared payments and compliance operations. In return you accept higher revenue share, tighter platform lock-in, and limited customization. Turnkey (“standalone”) setups require your own license, PSP contracts and compliance staffing, but pay back through margin expansion, data ownership, and more durable equity value. Regulatory reform in Curaçao and continuing scrutiny in top-tier jurisdictions have raised the bar on governance and costs, but they have also clarified long-term pathways for well-capitalized operators.

What “White Label” really buys you

Under a white label you receive a ready-to-operate brand on a provider’s platform and sub-license, usually with cashier, KYC/AML workflow, risk/fraud tooling, CRM, and a curated game catalogue. Time-to-market can be measured in weeks rather than months. Typical commercial models combine a setup fee with monthly minimums and revenue share. Current market quotes vary widely by provider and jurisdiction, but a realistic range we see in 2026 is low-five-figures for setup and a double-digit revenue share; for example, industry commentary cites ~€10k setup with revenue share up to ~15% for white label vs ~€30k setup and ~5% revenue share for turnkey platform supply. Your precise economics will depend on content, markets, PSP routing and managed-services scope.

White label works best when the go-to-market priority is speed, you’re still validating LTV/CAC and channel mix, or you plan to raise additional capital later to fund a migration to your own license. It is also useful for testing niche geographies and payment stacks before committing to a heavier regulatory footprint.

Where it bites later

You will trade control for convenience: higher take-rates to the platform, limits on bespoke features, and constraints on data access. If your brand gains traction, these frictions compress contribution margins and can depress valuation because buyers discount license dependency and vendor concentration risk. That’s why many operators treat white label as a bridge to a standalone model within 12–24 months.

Turnkey / Standalone: building an asset investors will pay for

In a turnkey model you contract a B2B platform (PAM, games aggregation, sportsbook, CRM) but operate under your own B2C license, with your PSP contracts and compliance team. This adds application lead times, internal KYC/AML ownership, and ongoing audits, but it typically reduces platform revenue share, expands payments coverage, and gives you full ownership of player data and IP, key value drivers in M&A. Reputable turnkey suppliers include SOFTSWISS, EveryMatrix, GiG (Platform/Sportsbook), and BetConstruct; each offers modular stacks and managed services to close gaps during launch and scale-up.

From an investor perspective, standalone licensing in a credible jurisdiction plus PSP redundancy and clean data rights often command stronger buyer interest. The trade-off is working capital and leadership focus to stand up governance, tech, and compliance.

Jurisdiction snapshot (fees, timelines, investor optics)

Note: Fees evolve; always confirm with the regulator or a licensed local advisor before committing. Figures below reflect regulator disclosures or widely referenced schedules as of August 15, 2026.

Malta (MGA – EU reputation, stringent compliance)

MGA is the gold-standard for cross-border B2C in Europe. Expect a €5,000 application fee and a €25,000 annual fixed license fee for B2C, plus a monthly “compliance contribution” scaled to gaming revenue. Strong governance expectations but excellent banking/PSP acceptance and partner ecosystem.

Curaçao (LOK regime – reformed framework, clearer oversight)

Curaçao’s reform took effect with the new law and the Curaçao Gaming Authority now issues direct B2C licenses, phasing out legacy sub-licenses. Commonly cited fee structure: application fee around ANG 9,000, annual license ANG 48,000 plus ANG 4,000 monthly supervision, and per-domain fees, exact schedules continue to be clarified as the regime beds in. Investor optics have improved as the country moves away from master/sublicense models.

Isle of Man (OGRA – credibility, stable regulator)

Well-regarded for probity and banking access. Government guidance lists an application fee of £5,250 and an annual license fee of £36,750 for a full OGRA B2C license; network licenses are higher. Solid choice for multi-jurisdictional strategies; strong fit for institutional investors.

Kahnawà:ke (Canada – CPA model, cost-effective, fast)

The Kahnawà:ke Gaming Commission’s Client Provider Authorization has historically offered efficient timelines. Publicly available references cite application fees around US$25k–40k and annual fees around US$20k, with specifics set by regulation and subject to change, use an approved local agent for current numbers.

Anjouan / Union of Comoros (cost-led, emerging)

Anjouan’s license surged in popularity in 2023–2026 as a low-cost, faster-processing option. Official portals exist, but fee transparency is less standardized publicly; operators should diligence local counsel and banking/PSP acceptance carefully since investor perception varies by market mix and risk controls.

Gibraltar & Alderney (top-tier, selective)

Both are highly reputable but selective and more expensive, typically suited to scaled, well-capitalized brands targeting tightly regulated markets; they can enhance investor sentiment but entail longer pathways and higher fixed overhead.

Payments: from “it works” to “it scales”

Payment acceptance is one of the most consequential levers in iGaming economics. Best-in-class operators deploy payment orchestration to route transactions across multiple PSPs/APMs, improving approval ratios and resiliency. Providers such as Nuvei (card, APMs, instant payouts; deep U.S. iGaming footprint) and Praxis Tech (gateway orchestration and smart routing) are commonly integrated in both white-label and turnkey stacks. Crypto rails (e.g., CoinsPaid) are used by some operators for specific markets, with instant conversion to fiat to manage volatility and risk. Bank and card coverage remains essential for mainstream traffic and Tier-1 PSP relationships.

Providers you’ll encounter (shortlist)

White-label specialists (rapid UK/EU entry via provider licenses):

White Hat Gaming (white label & PAM), ProgressPlay, SkillOnNet. These firms market quick brand launches, payment stacks, CRM, and managed operations, useful for speed or when testing markets. Validate which jurisdictions their umbrella licenses cover for your target geographies.

Turnkey/platform vendors (build your own licensed operation):

SOFTSWISS, EveryMatrix (CasinoEngine + GamMatrix turnkey), GiG (platform & managed services), BetConstruct (API/Turnkey/White-label). Each is modular; negotiate data ownership, migration support, and PSP flexibility up front.

Cost & timeline reality check

-

White label: fastest launch with low-five-figure setup and a double-digit revenue share in many cases; you piggyback on the provider’s license and cashier, which trims compliance headcount. Budget for higher take-rates and limited bespoke work.

-

Turnkey: expect regulator fees (see jurisdiction snapshot), vendor setup/integration, and internal compliance hires. MGA and IOM can take several months depending on completeness; Curaçao’s reformed regime is improving predictability. Over a multi-year horizon, reduced revenue share, better PSP economics, and data control typically offset the upfront spend.

Investor lens: what drives valuation

License quality & portability.

- Buyers prefer assets with respected licenses (MGA, IOM, Alderney, Gibraltar) and clean market exposure. Curaçao’s reform has improved diligence outcomes for serious operators under the new regime.

Data rights & platform dependency.

- White-label brands often face lower multiples due to limited control over player data, product roadmap and payments. Turnkey builds with clear IP and migration rights command stronger interest.

PSP resilience.

- Multi-acquirer routing and proven acceptance in core markets reduce volatility in NGR and cash conversion, now standard in advanced diligence.

Scale signals from B2B vendors.

- Continued consolidation and strong B2B economics (e.g., EveryMatrix reporting record net revenue and >€100m LTM EBITDA) underscore investor appetite for robust iGaming infrastructure, and show what “good” looks like operationally.

Sector consolidation.

- Aristocrat’s acquisition of NeoGames (which folded in Aspire Global’s platform, Pariplay aggregation and BtoBet sportsbook) illustrates ongoing integration of content, PAM and managed services, favorable for operators who align to scalable stacks.

White Label Casino and Standalone Casino Options Compared

Which model should you choose?

Which model should you choose?

If your mandate is to validate a brand quickly, conserve capital, and learn your acquisition channels, start white label with a clear step-up plan. Negotiate data export rights, “path to turnkey” commercial breaks, and defined SLAs for migrations.

If you already have traffic sources, a multi-market plan, or are optimizing for a strategic exit, go turnkey and invest in licensing, payments, and analytics early. The additional governance and cash burn in year one typically translate into structurally higher contribution margins and better buyer confidence by years two and three.

Key takeaways

-

White label maximizes speed and minimizes setup cost but reduces control and margin; treat it as a bridge, not a destination, if you aim for premium valuations.

-

Turnkey with your own license requires more capital and compliance but unlocks payments flexibility, data ownership, and better exit optionality.

-

Jurisdiction matters: MGA and IOM carry strong investor optics; Curaçao’s new regime has improved credibility; Kahnawà:ke and Anjouan can be faster/lower cost but require careful PSP/banking planning.

-

Payments orchestration is not optional at scale; build multi-PSP routing and instant payout capabilities into your plan from day one.

-

The B2B landscape is consolidating; align with platform partners that are financially strong, modular, and transparent on migration paths.

Frequently Asked Questions

What is the realistic budget to launch?

For a white-label brand, plan for a low-five-figure setup plus monthly fees and a double-digit revenue share. For turnkey, combine regulator fees (see jurisdiction section), vendor integration, legal, and 6–12 months of operating runway. Several providers publicly pitch turnkey builds at ~€30k setup plus a lower revenue share, but your total project cost will scale with content, payments, and geographies.

How long do licenses take?

MGA and Isle of Man timelines typically run several months if your pack is complete. Curaçao’s reformed process continues to standardize under the new authority. Kahnawà:ke and Anjouan can be faster but require careful vendor and banking alignment to avoid bottlenecks post-launch.

Can I start white label and move to my own license later?

Yes, negotiate a migration clause at signature. Ensure you can export player data, CRM segments, and responsible gaming history in regulator-acceptable formats, and align PSP handovers early.

Which providers should I shortlist?

For white label: White Hat Gaming, SkillOnNet, ProgressPlay (especially for UK coverage). For turnkey/platform: SOFTSWISS, EveryMatrix, GiG, BetConstruct. Always diligence data rights, roadmap, and PSP strategy, not just game count.

What moves the needle most in an exit?

License quality, clean market exposure, strong payments acceptance (with orchestration), owned data and IP, sustainable NGR growth with transparent LTV/CAC, and limited vendor lock-in. Evidence of regulatory audits and responsible gaming maturity also reduces buyer discount rates.