By 2026, Flippa has cemented its position as a go-to marketplace for domain investors and website flippers alike. However, its fee structure, limited vetting processes, and one-size-fits-all approach leave many buyers and sellers seeking more specialized, higher-touch alternatives.

Whether you’re an iGaming operator evaluating a strategic exit or an entrepreneur looking to offload a profitable content site, selecting the right platform can make all the difference in securing competitive bids and navigating due diligence.

In this guide, we leverage a decade of iGaming M&A advisory experience to examine 12 proven Flippa alternatives. We begin with CasinosBroker.com—our recommendation for regulated gaming assets—followed by leading marketplaces and boutique brokerages such as Sedo, Empire Flippers, FE International, and Quiet Light.

In this guide, we leverage a decade of iGaming M&A advisory experience to examine 12 proven Flippa alternatives. We begin with CasinosBroker.com—our recommendation for regulated gaming assets—followed by leading marketplaces and boutique brokerages such as Sedo, Empire Flippers, FE International, and Quiet Light.

For each option, we highlight deal-size ranges, fee structures, and unique value propositions to help you choose the ideal channel for your next online-business transaction.

Best Flippa Alternatives to Buy & Sell Online Businesses

1.) CasinosBroker.com

CasinosBroker.com specializes in advising on the acquisition and disposition of iGaming and online casino businesses, leveraging deep industry expertise to match buyers with sellers efficiently.

CasinosBroker.com specializes in advising on the acquisition and disposition of iGaming and online casino businesses, leveraging deep industry expertise to match buyers with sellers efficiently.

With dedicated teams focused on due diligence, valuation, and deal structuring, CasinosBroker.com acts as a single point of contact throughout the entire M&A process, ensuring that every transaction maximizes value while minimizing risk.

2.) Sedo

Sedo remains one of the most trusted marketplaces for buying and selling domain names and established websites. By directly connecting buyers and sellers, Sedo’s platform simplifies negotiations and closes deals faster.

Sedo remains one of the most trusted marketplaces for buying and selling domain names and established websites. By directly connecting buyers and sellers, Sedo’s platform simplifies negotiations and closes deals faster.

Key services include domain appraisals, brokerage assistance, escrow protection, and a global domain marketplace that consistently features premium inventory.

As demand for memorable domain names increases—especially within competitive sectors like iGaming—Sedo’s extensive inventory and protective services become invaluable to investors seeking high-quality digital real estate.

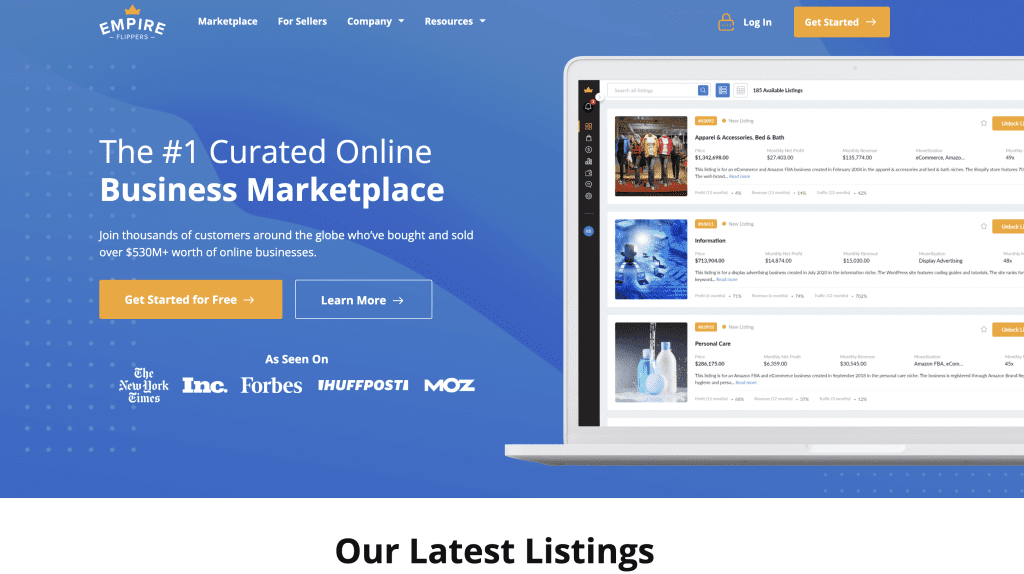

3.) Empire Flippers

Founded in 2010 (initially as Adsense Flippers), Empire Flippers has grown into one of the leading curated marketplaces for buying and selling profitable, online businesses.

Founded in 2010 (initially as Adsense Flippers), Empire Flippers has grown into one of the leading curated marketplaces for buying and selling profitable, online businesses.

To date, they have facilitated over 2,000 transactions totaling more than $500 million, helping sellers net “thousands of dollars” per deal by matching listings with vetted buyers in niches ranging from affiliate sites to SaaS platforms.

Sellers benefit from a transparent vetting process that requires a minimum of $2,000 average monthly profit over 12 months, ensuring only high-quality, revenue-generating websites make it to the marketplace. Buyers gain access to a broad portfolio of content-driven sites, eCommerce stores, and Amazon FBA businesses that are updated with new listings every Monday at 10 am EST.

4.) Quiet Light

Quiet Light specializes in advisory services for high-value online businesses, particularly in the $100,000 to $20 million range. Since its founding by Mark Daoust in 2007, Quiet Light has guided over 6,000 entrepreneurs through the process of valuation, positioning, and exit planning.

Quiet Light specializes in advisory services for high-value online businesses, particularly in the $100,000 to $20 million range. Since its founding by Mark Daoust in 2007, Quiet Light has guided over 6,000 entrepreneurs through the process of valuation, positioning, and exit planning.

Their seasoned advisory team executes a proven methodology: conducting deep due diligence, crafting investment teasers, and negotiating on behalf of clients to drive bidding competition.

With a track record of over $300 million in completed transactions, Quiet Light’s reputation for personalized guidance makes them a preferred choice for owners seeking a hands-on approach to achieving optimal sale prices.

5.) Investors Club

Launched by seasoned niche-site investor Andrej Ilisin in 2019, Investors Club is a membership-based platform that grants vetted buyers access to detailed financials for subscription-tier listings. By requiring proof of funds and a paid membership, Investors Club ensures that only serious buyers can view sensitive deal data.

Launched by seasoned niche-site investor Andrej Ilisin in 2019, Investors Club is a membership-based platform that grants vetted buyers access to detailed financials for subscription-tier listings. By requiring proof of funds and a paid membership, Investors Club ensures that only serious buyers can view sensitive deal data.

Sellers benefit from a streamlined sales process with guaranteed 45-day close times, no-fee escrow services, and professional guidance on legal documentation and domain transfer. Membership fees lock in a selling commission rate of 5%—one of the lowest in the industry—while providing sellers with free valuations, extensive due diligence, and the promise of “compensation for time” if a listing does not sell.

6.) FE International

Since its inception in 2010, FE International has established itself as a top-tier M&A advisor and brokerage for mid-market technology businesses.

Since its inception in 2010, FE International has established itself as a top-tier M&A advisor and brokerage for mid-market technology businesses.

With over 1,500 successful acquisitions and a 94.1 percent success rate, FE International is trusted for selling SaaS, eCommerce, and content companies typically valued between $50,000 and $20 million.

Their global network of 80,000+ pre-qualified investors, combined with offices in New York, San Francisco, Miami, and London, ensures broad market reach. Sellers receive comprehensive support, including bespoke asset purchase agreements, rigorous financial due diligence, and confidential marketing to vetted buyers.

Buyers benefit from access to high-quality, mid-market businesses backed by FE International’s commitment to confidentiality and transaction integrity.

7.) Buy Sell Empire

Buy Sell Empire operates as a private, invitation-only marketplace connecting entrepreneurs and investors interested in acquiring profitable online businesses. With a network of over 10,000 active buyers and sellers, platform members gain access to proprietary deal flow in niches such as iGaming, SaaS, and eCommerce.

Buy Sell Empire operates as a private, invitation-only marketplace connecting entrepreneurs and investors interested in acquiring profitable online businesses. With a network of over 10,000 active buyers and sellers, platform members gain access to proprietary deal flow in niches such as iGaming, SaaS, and eCommerce.

Sellers receive a free valuation and a dedicated broker who manages negotiations, due diligence, and legal documentation. With a success rate exceeding 90 percent, Buy Sell Empire’s selective entry criteria and hands-on deal facilitation help streamline transactions for niche-site owners who seek privacy and dedicated attention.

8.) Dealflow Brokerage

Founded in 2014 by Jamie Toyne—former director at Flippa—Dealflow Brokerage marries deep industry experience with M&A advisory best practices. Specializing in small to mid-market transactions, Dealflow provides tailored strategies for businesses ranging from content websites to SaaS platforms and Amazon FBA ventures.

Founded in 2014 by Jamie Toyne—former director at Flippa—Dealflow Brokerage marries deep industry experience with M&A advisory best practices. Specializing in small to mid-market transactions, Dealflow provides tailored strategies for businesses ranging from content websites to SaaS platforms and Amazon FBA ventures.

By leveraging backgrounds in investment banking, legal counsel, and entrepreneurship, Dealflow’s team offers end-to-end services: valuation support, buyer identification, negotiation, and post-sale transition planning. Their platform emphasizes transparency, providing detailed financial metrics and historical performance data to potential buyers, thereby reducing friction and accelerating deal closures.

9.) Website Closers

Website Closers serves as a full-service brokerage for entrepreneurs looking to buy or sell online businesses valued up to $500 million. With extensive experience across verticals—iGaming included—their advisors provide market valuations, growth forecasts, and strategic marketing materials to ensure maximum exposure.

Website Closers serves as a full-service brokerage for entrepreneurs looking to buy or sell online businesses valued up to $500 million. With extensive experience across verticals—iGaming included—their advisors provide market valuations, growth forecasts, and strategic marketing materials to ensure maximum exposure.

Sellers benefit from a global network of buyers, confidentiality protocols, and specialized guidance on scaling operations pre-sale. Buyers can browse a curated inventory of eCommerce stores, affiliate sites, SaaS solutions, and digital agencies, often with proprietary growth data and third-party audits included.

As a preferred alternative to Flippa for high-value transactions, Website Closers combines hands-on advisory with robust market intelligence.

10.) Digital Exits

Since its founding in 2013 by Jock Purtle, Digital Exits has completed dozens of successful deals—focusing on businesses with annual revenues between $250,000 and $5 million.

Since its founding in 2013 by Jock Purtle, Digital Exits has completed dozens of successful deals—focusing on businesses with annual revenues between $250,000 and $5 million.

By emphasizing personalized service, Digital Exits guides entrepreneurs through valuation, buyer outreach, and due diligence. Their proven marketing process often results in multiple offers within weeks, with closed deals typically consummated in under 60 days.

Sellers appreciate Digital Exits’ transparent fee structure and post-sale support options, such as transition consulting. Buyers gain access to profitable online ventures across sectors, including content sites, SaaS applications, and niche marketplaces.

11.) Freemarket

Freemarket.com operates as a free, unvetted marketplace where anyone can list a domain name or website for sale—reminiscent of Flippa’s early days. While listing is free, Freemarket charges a 5 percent commission on completed sales.

Freemarket.com operates as a free, unvetted marketplace where anyone can list a domain name or website for sale—reminiscent of Flippa’s early days. While listing is free, Freemarket charges a 5 percent commission on completed sales.

The open nature of the platform means buyers must exercise extra diligence, as listings are not pre-verified; this increases the risk of encountering expired domains, abandoned sites, or fraudulent offers. However, patient buyers willing to conduct thorough research can sometimes discover undervalued gems.

Sellers enjoy an accessible, no-barrier entry to the market but must be prepared to manage due diligence and negotiation themselves.

12.) NicheInvestor

Formerly known as BlogForSale, Nicheinvestor.com is an online boutique marketplace specializing in “cash-cow” websites and niche digital assets.

Formerly known as BlogForSale, Nicheinvestor.com is an online boutique marketplace specializing in “cash-cow” websites and niche digital assets.

Founded by Chelsea Clarke—an IBBA member with a decade of online media experience—the platform has facilitated over 320 transactions totaling in excess of $320 million.

Nicheinvestor emphasizes sites with predictable revenue, such as content blogs, membership portals, and specialized eCommerce stores. Sellers benefit from a curated pool of qualified buyers, tailored marketing materials, and auction-style listings that drive competitive bids.

Buyers—often investors looking to fast-track growth—gain access to turnkey websites in underserved niches, complete with historical traffic and revenue data.

Key Takeaway

Whether you’re looking to offload a niche blog, a SaaS application, an Amazon FBA store, or an online casino, a specialized intermediary can make the difference between a stagnant listing and a multi-offer bidding war.

Platforms like FE International (94.1 percent success rate, $1.5 billion+ in closed deals and CasinosBroker.com (iGaming-focused valuations via ValuGen™) provide tailored advisory services, whereas marketplaces such as Empire Flippers and Sedo offer scalable exposure and lower entry thresholds.

Choosing the right alternative to Flippa depends on business size, vertical, and the level of white-glove support required.

Summary Table of Key Platforms

| Platform | Focus | Typical Deal Size | Commission / Fees | Unique Feature |

|---|---|---|---|---|

| CasinosBroker.com | iGaming M&A | $500K – $50 M | 8 percent + due diligence costs | ValuGen™ valuations, licensing due diligence |

| Sedo | Domain & Website Sales | $1 – $100 K+ | Listing: $29 – $99; 10 percent closing | Global domain marketplace, escrow protection |

| Empire Flippers | Profitable Online Business | $60 K – $5 M+ | 15 percent on first $700K, 8 percent → 2 percent above $700K | Curated, vetted listings; new content added weekly |

| Quiet Light | High-Value Online Businesses | $100 K – $20 M | 10 percent – 15 percent | Advisory-driven sales process; “six-figure to eight-figure” focus |

| Investors Club | Niche Sites (Affiliate/Display) | $20 K – $250 K | 5 percent (membership-locked) | Exclusive membership with proof-of-funds; 45-day close |

| FE International | SaaS, eCommerce, Content | $50 K – $20 M | 10 percent – 15 percent + 2.5 percent buyer fee | 94.1 percent success rate; 1,500+ deals closed |

| Buy Sell Empire | Profitable Online Businesses | $50 K – $10 M | 10 percent – 15 percent | Invitation-only private marketplace |

| Dealflow Brokerage | Small to Mid-Market Online Businesses | $25 K – $2 M | 10 percent – 12 percent | Former Flippa director; end-to-end M&A advisory |

| Website Closers | Up to $500M Business Sales | $200 K – $500 M+ | 6 percent – 15 percent | Full-service brokerage; global buyer network |

| Digital Exits | $250 K – $5 M Annual Revenue | $250 K – $5 M | 10 percent – 12 percent | Rapid deal closures (< 60 days); post-sale support |

| Freemarket | Open Marketplace for Domains/Websites | $1 – $50 K | 5 percent sales commission | Free listing; no vetting; high risk/ reward |

| Nicheinvestor | Cash-Cow Niche Websites | $10 K – $500 K | 10 percent – 15 percent | Auction-style listings; focus on niche-driven growth |

FAQ

Q1: What criteria should I consider when choosing a Flippa alternative?

When selecting a marketplace or brokerage, evaluate your business’s revenue, growth trajectory, niche, and required level of advisory support. For six- and seven-figure valuations, opt for full-service M&A advisors (e.g., FE International, Quiet Light, CasinosBroker.com).

If your site generates at least $2,000 per month and you seek rapid listings, consider vetted marketplaces like Empire Flippers. For domain-only transactions or smaller sites (sub-$50K), Sedo and Freemarket offer cost-effective exposure.

Q2: How do fees and commissions differ across platforms?

Commission structures vary from flat percentages to tiered models. Sedo charges a 10 percent closing fee plus a small listing cost. Empire Flippers uses a stacked commission (15 percent up to $700K, 8 percent between $700K–$5M, 2 percent above).

FE International typically charges 10 percent – 15 percent on the seller side plus a 2.5 percent buyer fee. Quiet Light and Digital Exits generally range from 10 percent – 15 percent. Investors Club caps selling fees at 5 percent but requires membership. Always confirm whether buyer fees or listing costs apply.

Q3: Are there any specialized options for iGaming businesses?

Yes—CasinosBroker.com specializes in iGaming M&A, navigating licensing requirements, assessing KYC/AML protocols, and valuing player databases.

They offer proprietary tools (ValuGen™) that factor in lifetime value metrics and regulatory compliance. While other platforms might list iGaming sites, only CasinosBroker.com provides dedicated legal, licensing, and operational expertise for casino operators and affiliates.

Q4: What due diligence should I expect on each platform?

- Sedo and Freemarket rely on buyer due diligence—sellers should prepare up-to-date traffic reports, revenue statements, and domain ownership documentation.

- Empire Flippers vets listings by verifying at least 12 months of profit history and Google Analytics data.

- FE International and Quiet Light conduct full financial audits, customer contract reviews, and qualitative assessments (e.g., competitive positioning).

- Investors Club and Buy Sell Empire require proof of funds for buyers before disclosing detailed deal data.

- CasinosBroker.com performs specialized due diligence on licensing authorities, regulatory compliance, and operational KYC/AML.

Q5: How long does it typically take to sell an online business?

Timelines vary by platform and deal size. On marketplaces like Empire Flippers or Sedo, average time to sale is 30 – 60 days, depending on listing quality and market demand.

For niche marketplaces (Investors Club), targeting qualified buyers may compress deals to 45 days. Full-service M&A advisors (FE International, Quiet Light, CasinosBroker.com) often close mid-market transactions within 3 – 6 months, allowing for thorough due diligence and negotiation.

Q6: Can I list the same business on multiple platforms simultaneously?

You can, but overlapping listings require careful coordination to avoid duplicate negotiations or buyer confusion. Some brokerages demand exclusivity for a set period (e.g., FE International typically requires 90 days). Before listing, review each platform’s exclusivity policy. If you prefer broader exposure, coordinate staggered listings or use marketplaces with non-exclusive terms (e.g., Sedo, Freemarket).

Q7: What additional services do these platforms offer beyond listing?

- Valuation and appraisal (Sedo, FE International, Quiet Light, Investors Club)

- Legal document preparation (Investors Club, Dealflow Brokerage)

- Escrow services for secure payment (Sedo, Freemarket, Empire Flippers)

- Post-sale transition support (Digital Exits, Quiet Light, CasinosBroker.com)

- Growth advisory and operational consulting (Dealflow Brokerage, CasinosBroker.com)

By understanding the distinct focus, fee structures, and service levels of each platform, entrepreneurs can choose the ideal alternative to Flippa—whether they’re selling a niche blog, an iGaming affiliate site, or a seven-figure eCommerce store.